Target business analysis

Overview

The St. Petersburg Area Chamber of Commerce and the city of St. Petersburg have embarked on a comprehensive process to assess and enhance the city’s competitive position to support quality, diverse economic growth now and in the future. As other cities in Florida and across the country focus increased resources and attention on growing their economies, how St. Petersburg is positioned for quality growth is a critical issue to address. Comprehensive quantitative and qualitative research has informed the development of this Grow Smarter Initiative Strategy. Thephases of the Initiative include:

COMPETITIVE ASSESSMENT

The Competitive Assessment presented a detailed examination of the city of St. Petersburg’s competitive position as a place to live, work, visit, and do business. Rather than simply describing data trends, the Competitive Assessment synthesized key findings from the analysis and community input framing the discussion around key “stories” and competitive issues faced by the community.

TARGET BUSINESS ANALYSIS AND MARKETING REVIEW

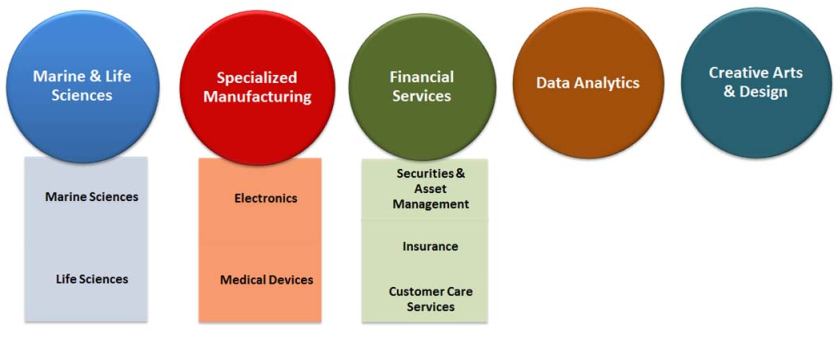

Using the findings from the first phase, the business sectors that most strongly align with St. Petersburg’s competitive strengths are reviewed and defined. This Target Business Analysis evaluated the city’s workforce, existing economic strengths, global trends, and both obvious and “aspirational” job sectors. The goal of the Target Business Analysis was to identify how to diversify and strengthen the economy through entrepreneurship, existing business expansion, and recruitment. A Marketing Review also assessed the city of St. Petersburg’s principal marketing programs and tools. The following graphic represents the approved target sectors that will drive diverse economic growth in St. Petersburg in the coming years:

Target “niches” represent sub-categories that can be differentiated in terms of compositional subsectors and growth dynamics, but nevertheless share complimentary strategic concerns and competitive advantages such as talent, buyer/supplier networks, infrastructure, technologies, marketing messaging, and others, that warrant them being considered under the same overarching target category. Specific actions to grow the city of St. Petersburg’s recommended target sectors are included in this Grow Smarter Initiative Strategy.

GROW SMARTER INITIATIVE STRATEGY

This Strategy is holistic and inclusive of the many components that affect St. Petersburg’s ability to be a prosperous community. The Strategy’s proposed goals, strategies, and actions have been built from the key findings of the research reports.

IMPLEMENTATION PLAN

While the Strategy represents “what” St. Petersburg needs to do, the Implementation Plan determines “how” to do it. The Implementation Plan will serve as the road map for putting the Strategy into motion. The Implementation Plan outlines the activities of the Strategy’s objectives on a day-by-day, month-bymonth, and year-by-year basis.

Introduction

Targeting key employment sectors for growth and potential development into “clusters” of economic activity has become a nearly universal method of expanding and diversifying local economies. “Targets” represent segments of an economy where competitive advantages exist, prospects for future growth are greatest, and return on investment is likely highest. While targets are comprised of groups of categorically linked businesses strategically pursued by an economic development organization and its partners, clusters represent groups of interrelated businesses that co-locate due to “economies of scale” in multiple competitive factors. There are a variety of different catalysts that support these agglomerations, which can occur among competing or cooperative firms. A group of suppliers may choose to locate in proximity to a major manufacturer for research and development efficiencies and reduced transportation costs. Other firms may co-locate in a specific area in order to take advantage of a specialized labor pool or to be in close proximity to specific infrastructure. The advantages derived by firms from these catalysts, coupled with the network effects that often exist within clusters, often result in comparatively high potential for employment growth and wealth creation. Due to limited economic development resources, it is sensible for regions to strategically target those sectors with the greatest potential to create new jobs and raise incomes.

While not all targets will eventually become clusters, growth in these sectors will nevertheless help drive local wealth-creation. Strategically targeting these business categories helps communities take advantage of their particular strengths in existing companies, workforce capacity, research investment, infrastructure, and other resources. Due to the realities of today’s economy and constrained public and private investment budgets, it is prudent for communities to target those sectors with the greatest potential to create new jobs and raise per capita income.

This report proposes target sectors that are specific to the competitive position of the city of St. Petersburg. In keeping with the intent of the Grow Smarter process, care was taken to only focus on those employment concentrations, place-based assets, research and innovation capacity, and business climate issues specific to the city itself and not Pinellas County or the Tampa Bay region. Only in the case of workforce development did Market Street incorporate training capacity beyond the city’s borders. This is consistent with the reality that companies will assess a regional labor shed when determining training capacity to support locally-created positions. Consistencies between the proposed St. Petersburg targets and categories pursued at the county and regional level were only identified to communicate the potential benefits accrued from leveraging the marketing capacity of additional organizations.

Target sectors proposed for the city of St. Petersburg emerged from the research and findings of the Competitive Assessment, public input process, as well as detailed analysis of the city’s economic and occupational structure and key competitive assets.

Key criteria in target sector identification were:

- Occupational trends and education and training capacity

- Current employment totals and concentrations for all sectors and subsectors

- Future development opportunities

- Research and commercialization capacity

- Presence of top employers capable of being “magnets” for buyers and suppliers

- Average wage data and ability to raise levels of local wealth

Based on the full breadth of analysis, Market Street recommends that the city of St. Petersburg pursue the following target business sectors and associated niches:

Target “niches” represent sub-categories that can be differentiated in terms of compositional subsectors and growth dynamics, but nevertheless share complimentary strategic concerns and competitive advantages such as talent, buyer/supplier networks, infrastructure, technologies, marketing messaging, and others, that warrant them being considered under the same overarching target category.

Marine and Life Sciences

Niches: Marine Sciences, Life Sciences

While the city of St. Petersburg has concentrated employment in both the marine and life sciences, it is the potential synergies between the two that can be transformative for the local economy. The environments of the ocean and the human body share certain properties that can foster research in disease resistance and treatment beneficial to the science of living systems as a whole. While the niches of Marine Science and Life Science can still grow independently, strategies to integrate the two will have the highest potential payoff for the city’s economy.

Specialized Manufacturing

Niches: Electronics, Medical Devices

Specialized Manufacturing features some of St. Petersburg’s most concentrated employment sectors. In, fact, production of electronics components and medical devices represents a true employment cluster for the city and features some of its most prominent and successful companies. Market Street combined these niches under a larger Specialized Manufacturing target to acknowledge consistencies with high-tech production processes, transferability of certain manufacturing-based occupations and training programs, and key business climate concerns shared by production-oriented firms.

Financial Services

Niches: Security and Asset Management, Insurance, Customer Care Services

By far the largest target sector in terms of employment, Financial Services is another legitimate employment cluster in the city of St. Petersburg. Major headquarters firms in this sector are located throughout the city, but are primarily concentrated in north St. Petersburg. As with other targets featuring component niches, Financial Services’ subsectors are differentiated development categories but feature enough similarities in workforce demands, training resources, technology needs, and business-climate dynamics to warrant inclusion under a broader umbrella.

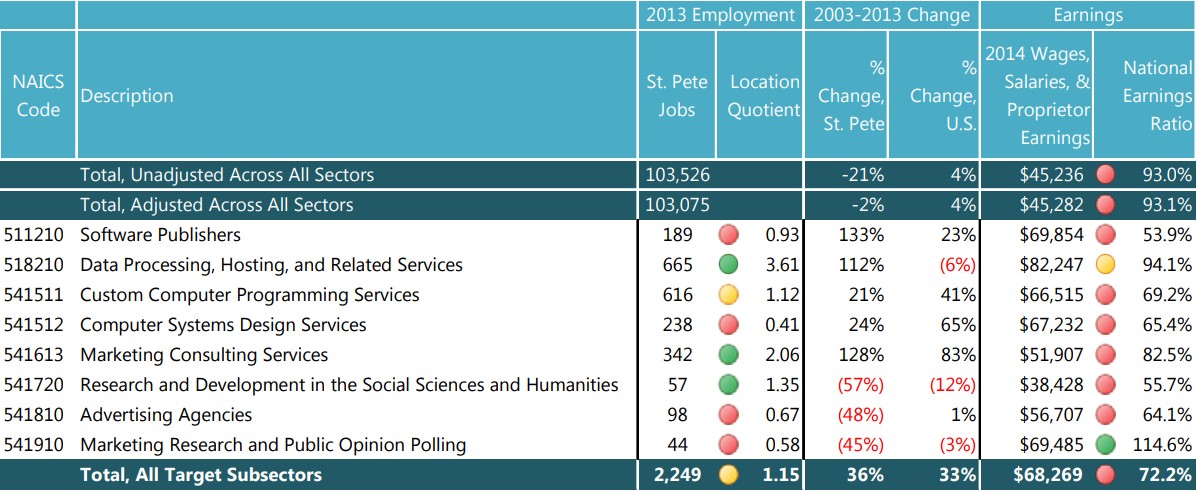

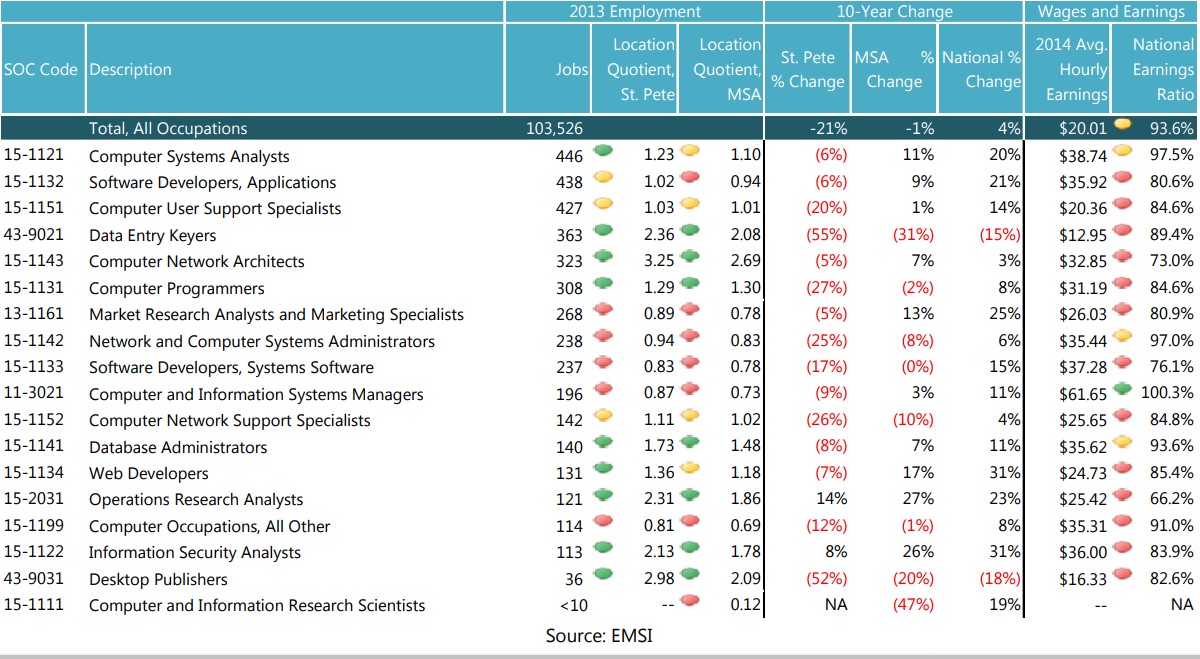

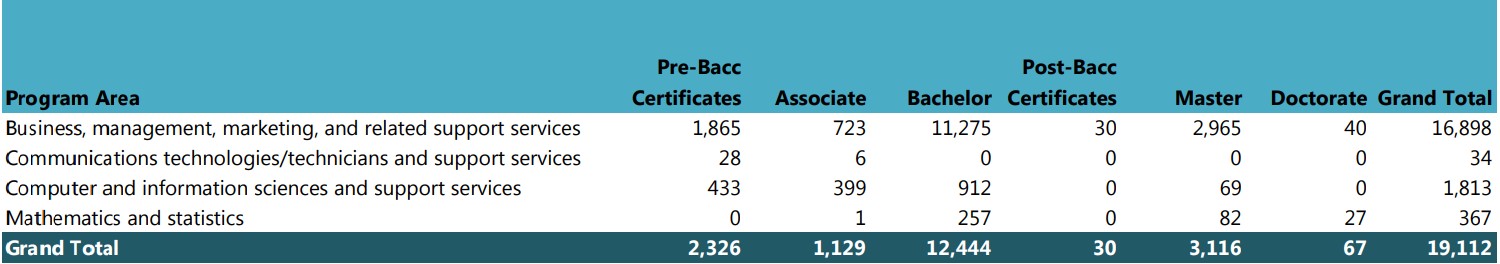

Data Analytics

An emerging sector in the city of St. Petersburg, Data Analytics leverages non-core competencies that are prevalent in the operations of major employers such as like HSN, Valpak, and Raymond James that capture and analyze “Big Data,” and also companies that produce products and processes to enable other firms to benefit from making sense of the volumes of data produced by our economy every minute, hour, and day.

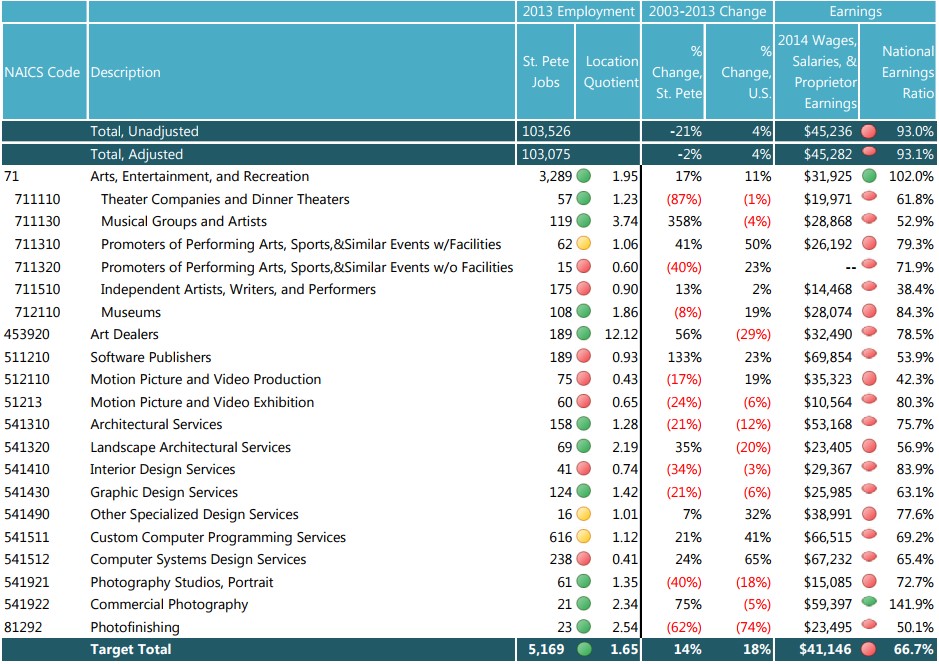

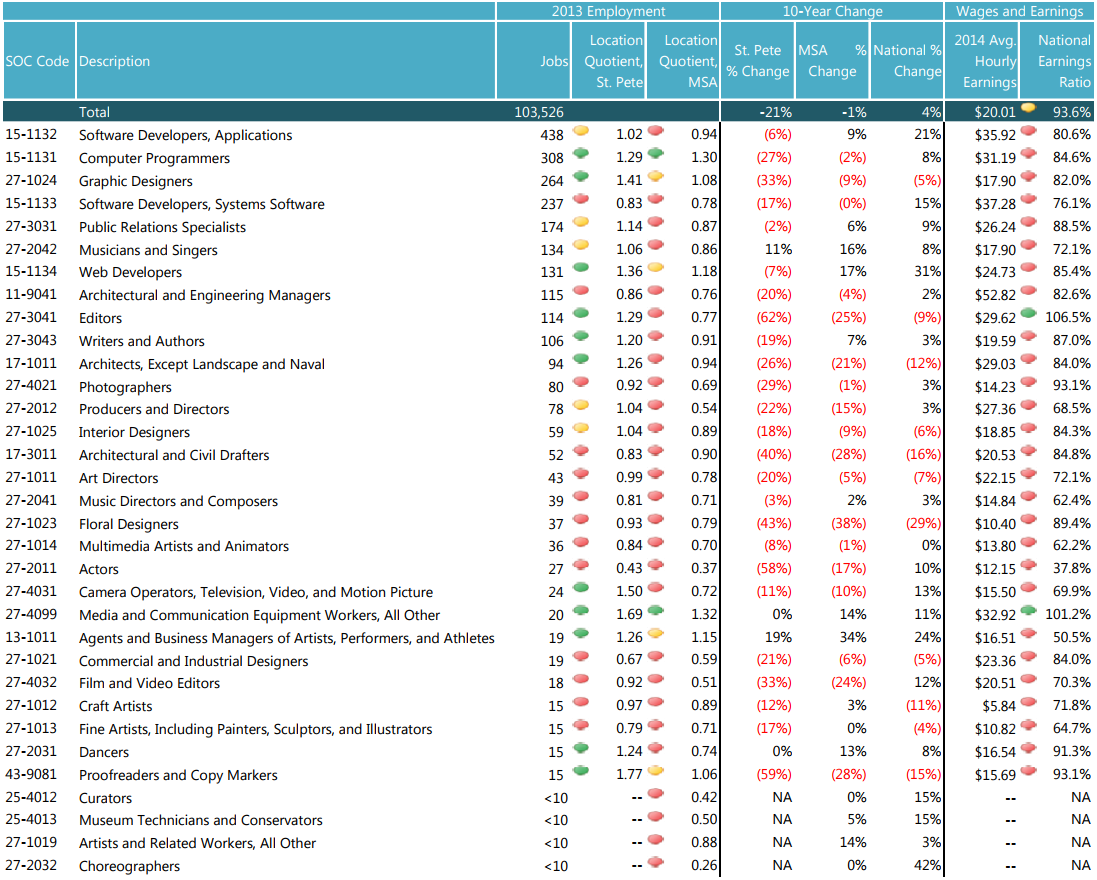

Creative Arts and Design

Though St. Petersburg has a long history of strength in the arts, this target would also be an emerging sector for the city. In addition to the role that the arts play in bolstering St. Petersburg’s standing as a tourist and residential destination, design can also be positioned as a growth sector if skills in multi-media can be applied to – and exposed to – new online, cellular, and digital markets.

It is important to note that this Target Business Analysis is a research document, not a strategy. Collectively, these targets can help St. Petersburg become more specialized in areas of existing strength, grow jobs that can support economic diversification, support tourism, and nurture and create the community’s identity. This research report will analyze each target in detail and more fully explain why they merit strategic attention and what kind of strategic attention may be appropriate based on the research findings. Specific actions to grow the city of St. Petersburg’s recommended target sectors will be included in the Grow Smarter Initiative Strategy.

METHODOLOGY AND CONCEPTS

In the field of economic development, there are many methods used to identify targets but most are based on incomplete or strictly industry-focused (business-sector-focused) methodologies. Such approaches ignore the variety of important issues from workforce attributes to educational assets to geographic advantages, all of which are vital to businesses. Market Street’s approach to target identification is rooted in a broader examination of the region’s workforce—the occupations and types of knowledge that support the region’s business activities—as opposed to strictly focusing on business sector composition and growth. It is complemented by an evaluation of the region’s business climate, infrastructure, research assets, educational programs, and many other items that factor into site location decisions for specific types of business activity.

CLASSIFICATION: Our approach does not strictly define targets based on North American Industry Classification System (NAICS) codes or Standard Occupational Classification (SOC) codes. Though these codes are used to help quantify important trends and activity within each target, they should not be interpreted as rigid definitions of the composition of economic activity within a given target. Classification codes are helpful in understanding target composition and growth, but they cannot adequately capture niche technologies and opportunities that may deserve strategic attention in certain communities.

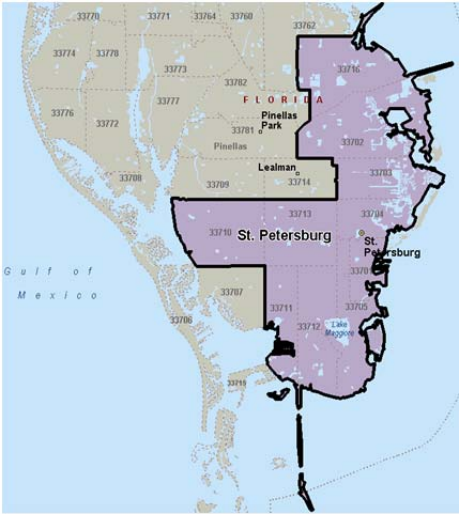

GEOGRAPHIES: The research related to business sector and occupational composition within this report is based on analysis of trends observed in the city of St. Petersburg, Florida. Because of data availability, the geography used is a proxy for the city and is defined by an aggregation of ZIP codes: 33701, 33702, 33703, 33704, 33705, 33710, 33711, 33712, 33713, and 33716. Consideration has also been given to regional assets located outside of city for specific competitive elements such as workforce development and marketing capacity. Additionally, MSA, state, and national trends were examined alongside local trends when relevant to best understand local dynamics.

MAP OF ZIP CODE AGGREGATION

LOCATION QUOTIENTS: Location quotients (LQs) are used to measure the relative concentration of local employment in a given business sector or occupation. When applied to business sector employment, they measure the ratio of a business sector’s share of total local employment to that business sector’s share of total national employment. A business sector with an LQ equal to 1.0 possesses exactly the same share of total local employment as that business sector’s share of national employment. When a local business sector possesses a location quotient greater than 1.0, this signals that the business sector is more heavily concentrated in the community than it is nationwide. Those business sectors with relatively large LQs are often assumed to benefit from one or more sources of competitive advantage derived from locating in the community being studied. Location quotients can also be applied to occupational employment in the same manner that they are applied to business sector employment, helping to determine which occupations and corresponding skill sets—irrespective of the business sectors that employ them—are highly concentrated in the local workforce.

INTER-INDUSTRY LINKAGES: Data covering inter-industry purchases provides tremendous insight into the degree to which firms benefit from co-location and the ability to purchase products and services from local suppliers. By examining the percentage of a sector’s requirements (expenditures) that are satisfied within the community (the city of St. Petersburg), it is possible to determine areas of expenditure leakage. When firms purchase goods from suppliers outside the region, money is leaving the region. When leakage is reduced, employment and income multipliers rise. That is to say, when leakage is reduced and clustered firms are sourcing locally, the economic impact of each new job created is maximized.

DATA SOURCES: The Target Business Analysis presents a variety of data on business sector employment composition, wages, establishments, occupational composition, workforce demographics, exports, interindustry expenditures, job openings, and degree completions. All of the aforementioned quantitative data is sourced from Economic Modeling Specialists, Inc. (EMSI), an industry-leading provider of proprietary data, aggregated from public sources such as the Census Bureau, the Bureau of Labor Statistics, the Bureau of Economic Analysis, the National Center for Education Statistics, CareerBuilder, and many others. EMSI was acquired by CareerBuilder in 2012.

ADJUSTMENT IN TOTAL EMPLOYMENT: As discussed in the Grow Smarter Initiative’s Competitive Assessment, St. Petersburg’s true employment situation may be mischaracterized by publicly available and proprietary data sources. The overwhelming majority of job losses experienced in St. Petersburg over a long-term historical time period were attributed to job losses among professional employer organizations (PEOs), which includes many employees are not physically located in the city. When PEOs are excluded from total employment figures, the employment situation looks much less severe and gives more accurate insight into the city’s economic performance over time. Because of this, each Employment Trends table featured in this analysis include unadjusted and adjusted totals across all sectors. The adjusted total removes employment in NAICS 56133 Professional Employer Organizations.

TIERED EMPLOYMENT ESTIMATES: In the Employment Trends tables, increasing levels of specificity are sometimes shown for the same NAICS code sequence. This is done to demonstrate a finer grain of detail on St. Petersburg’s specialties in this subsector. For example, in the Specialized Manufacturing target, 2,270 jobs are listed under NAICS 334 Computer & Electronic Product Manufacturing. Then, seven sub-codes of increasing specialization are listed below it. The employment in those seven sub-codes will add up to the 2,270 jobs of NAICS 334. This is why the “total employment” figures for each target do not add up to the sum of the employment column for all NAICS codes. Increasing levels of NAICS specificity are indicated through indentation of the codes.

SELECTED OCCUPATIONS: Occupations featured in the Occupation Statistics tables are not exhaustive lists of the occupations included in each target. These occupations are those that provide the skills and knowledge that drives the target and are the most prevalent within the subsectors listed in the Employment Trends tables. Additionally, all workers in the occupations featured are not necessarily employed within the target’s relevant subsectors. These tables are intended to illustrate the volume of talent available.

COMPANY REFERENCES: Throughout this document, several firms are mentioned as examples of existing firms that represent the St. Petersburg economy within target areas. A few of these firms may not be within the city limits of St. Petersburg, which prevents access to city incentives; however, they are still important to the St. Petersburg economy, taking advantage of Chamber membership benefits and employing St. Petersburg residents. It is important to note that the companies mentioned throughout this research document are but a fraction of the businesses that have made St. Petersburg home.

TARGET SECTORS

Marine and Life Sciences

Two place-based factors have made the city of St. Petersburg a competitive location for Marine and Life Sciences: its ocean and bayfront location and attractiveness as a retirement destination. While health care services have long been developed in St. Petersburg to serve its large population of elderly residents, the concentration of marine science assets is a more recent phenomenon, driven by a handful of key leaders and the growing cachet of the assets co-located in the Port of St. Petersburg. Though all counts of marine science employment in St. Petersburg are “unofficial” because the federal government does not specifically track this subsector, various experts have estimated that the city is one of the most concentrated hubs of marine science employment in the country. Though not as concentrated, life sciences is a burgeoning presence in St. Petersburg due to recent investments made by the global medical powerhouse Johns Hopkins Health Systems. St. Petersburg’s existing health care services capacity along with research and clinical trials conducted by the city’s physicians and medical experts support the growing life sciences segment of the economy.

While economic development will absolutely support growth of both niches of this target, the opportunities to find research and commercialization synergies between Marine and Life Sciences firms is the true catalytic opportunity in this target.

SUBSECTOR PERFORMANCE

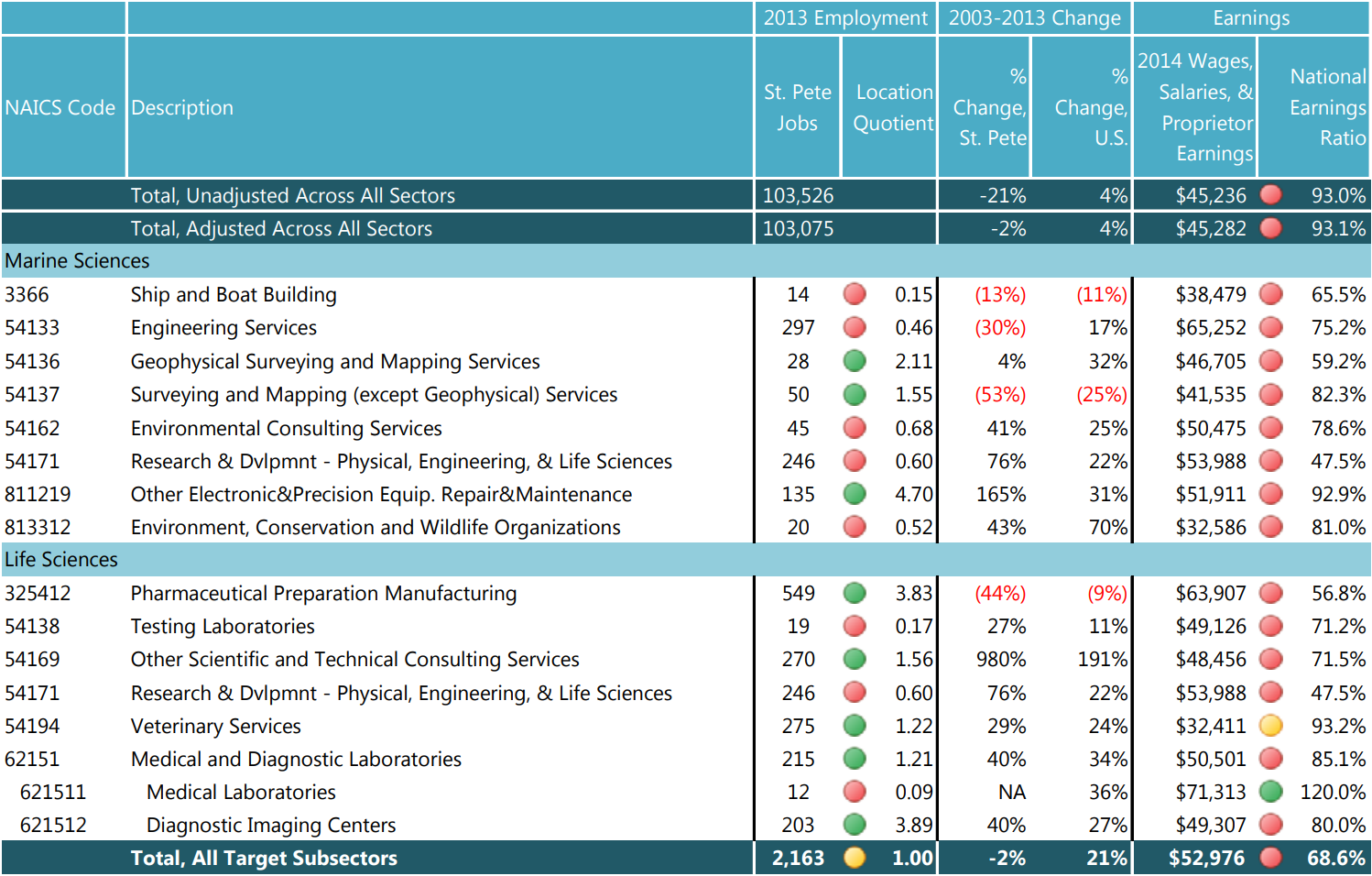

Both Marine Sciences and Life Sciences are difficult to define in terms of employment because of the complications in classifications of various firms that support these niches and because government employment is not available at fine-grain NAICS detail for the city. Therefore, the table that follows does not include the employment of the many federal agencies located in St. Petersburg that support this target.

For this analysis, Marine Sciences includes private sectors that cover ship and boat building, the design, development, and application of engineering processes and tools, surveying and mapping, environmental research, the upkeep of electronic equipment important to researchers, such as surveying instruments and radar equipment, and organizations that promote preserving and protecting the environment and wildlife.

Life Sciences is comprised of manufacturing uncompounded medicinal chemicals and other pharmaceutical preparations, testing, medical, and diagnostic laboratories, veterinary services, scientific and technical consulting, and research and development in physical, engineering, and life sciences.

EMPLOYMENT TRENDS, MARINE AND LIFE SCIENCES TARGET

Source: EMSI

Note: National Earnings Ratio Color Code is based on Tampa MSA Cost of Living Index of 93.2. Green

indicates that the wage is equal to or higher

than the national average wage for that subsector. Yellow indicates that while the wage is lower

than the national average, it is equal to or higher

than 93.2 percent, which accounts for the lower cost of living in St. Petersburg. Red is used for

any wage ratio less than 93.2 percent.

Note: Due to data limitations, this table provides private employment estimates only and does not

include the vast government employment in

St. Petersburg. As a broad reference, in 2013, there were 1,802 federal civilian employee in St.

Petersburg, up by 37 percent over the ten-year

period. However, this number includes every federal agency located in St. Petersburg, and not

limited to those supporting the Marine Sciences.

Although local employment in Marine and Life Sciences is equal to the nation’s concentration (LQ=1.0), the city of St. Petersburg has clear specializations in several subsectors, particularly those related to diagnostic, imaging, and surveying technologies. Within Marine Sciences, the city has significant employment concentrations in electronic and precision equipment repair and maintenance (LQ = 4.70), geophysical surveying and mapping services (2.11), and surveying and mapping (except geophysical) services (1.55). Within Life Sciences, St. Petersburg has concentrations in diagnostic imaging centers (LQ = 3.89), pharmaceutical preparation manufacturing (3.83), other scientific and technical consulting services (1.56), and veterinary services (1.22).

Overall, St. Petersburg firms in this target struggled over the ten-year period examined. While the Marine and Life Sciences grouping grew nationally by 21 percent over this time, St. Petersburg shed 46 net jobs, a decrease of two percent. This overall loss was driven by three main subsectors: pharmaceutical preparation manufacturing, which shed 439 jobs, engineering services, which lost 137 jobs, and surveying and mapping services, which lost 57 jobs. When examined as separated niches, Life Sciences subsectors (with the exception of the largest subsector: pharmaceutical preparation manufacturing) are growing at a faster pace than nationwide. Marine Sciences subsectors, however, are not experiencing competitive growth.

According to SRI International, a key research and development firm in St. Petersburg’s Marine Science research cluster, there are 800 researchers, engineers, technicians, and support staff in the downtown marine science district, sometimes referred to as the Bayboro Harbor Scientific Research District as well as Marine Science District. SRI estimates that 75 percent of these workers hold advanced degrees, a third of whom have Ph.D.s. The downtown district is supported by several major agencies and entities, including SRI International, the University of South Florida College of Marine Science, the Fish and Wildlife Research Institute, the National Oceanic and Atmospheric Administration (NOAA) National Marine Fisheries Service, the Florida Institute of Oceanography, the Tampa Bay Estuary Program, the International Ocean Institute, and the United States Geological Survey Coastal and Marine Science Center.

The Life Science niche is supported by top firms including but not limited to Draper Laboratory, InformedDNA, Cognitive Research Corporation, Bioplex Technologies, Dermazone Solutions, Catalent, and Smith & Nephew.

- Draper Laboratory, a not-for-profit research and development laboratory focused on the design, development, and deployment of advanced technological solutions for issues in security, space exploration, healthcare, and energy. In St. Petersburg, the firm has a 40,000 square foot Microelectronics Fabrication Center that develops Multichip Module (MCM) technology.

- InformedDNA touts itself as the nation’s largest independent provider network of genetics specialists enabled by a comprehensive evidence-based knowledge library for genetic tests and hereditary conditions.

- Cognitive Research Corporation is a full-service contract research organization that specializes in Central Nervous System (CNS) product development for the pharmaceutical, nutraceutical, biotechnology and medical device companies.

- Bioplex Technologies, a spin-off of the University of South Florida St. Petersburg’s College of Marine Science, is a provider of mobile diagnostic devices, assay chemistries & kits, samplers, sample preparation equipment and analytical equipment.

- Dermazone Solutions, Inc. is a life science company that through its proprietary nanotechnologies engineers all-natural particles around key active and bioactive ingredients to create topical and oral formulations.

- Catalent’s St. Petersburg location is the company’s primary softgel manufacturing facility in North America.

- Smith & Nephew is a global medical technology business, specializing in products related to orthopaedics reconstruction, advanced wound treatment, sports medicine, and trauma.

Despite the presence of key employers, Marine and Life Science firms do not comprise a large percentage of St. Petersburg’s exports, generating only 3.4 percent of the city’s exports, or $376 million, in 2011. Most of these were comprised by the pharmaceutical preparation manufacturing subsector, with $271.6 million in exports. This is largely due to the fact that a large segment of the Marine Sciences target niche is composed of the research organizations and government agencies referenced previously. One potential reason is that, nationwide in 2013, 30.1 percent of employees in the target work in engineering services (which is instrumental in research commercialization), while only 13.7 percent of workers in the target in St. Petersburg work in this field, down from 19.3 percent in 2003. Conversely, the Life Sciences niche is more oriented towards production than research.

As the city of St. Petersburg’s R&D organizations and firms continue to develop new technologies and make new marine and life science discoveries, there will need to be a focus on technology transfer and ensuring that researchers and entrepreneurs are encouraged to collaborate to create the spin-off companies necessary to the growth of exports for the city. Strengthening this component of the target is contingent on additional focus on more formalized and intentional commercialization processes.

OCCUPATION TRENDS

This target is supported by workers with three distinct groupings of skill/training levels: bachelor’s degrees and higher, associate degrees, and on the job training. The various types of engineers and scientists, the largest skill group in the target, have jobs that require at least a bachelor’s degree. Some positions require higher degree attainment of a master’s degree, such as hydrologists, or a doctoral degree, such as biological scientists. Technicians in this target are required to hold an associate degree, and production workers and medical assistants (veterinary assistants and phlebotomists) can receive short to moderate-term on the job training.

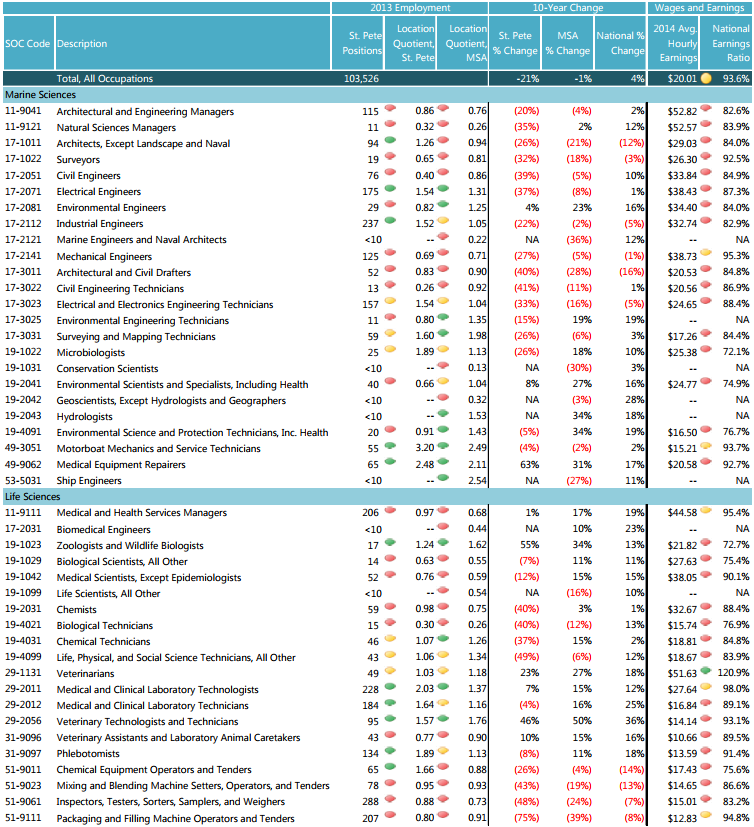

OCCUPATIONAL STATISTICS, MARINE AND LIFE SCIENCES TARGET, 2013

The city of St. Petersburg has experienced notable losses in these occupations. However, it is important to note that the regional talent pool should be taken into account. There are several relevant occupations with concentrations in the Tampa Bay region for the city to pull from, including environmental engineers, environmental science and protection technicians, hydrologists, and chemical technicians. With wages lower than the national average, the focus should be on connecting St. Petersburg’s talent pipeline to available Marine and Life Sciences jobs. Talent attraction is also a promising strategy with the area’s quality of life assets and the human capital generated by the cluster of activity occurring downtown.

Projected Workforce Gaps: By and large, talent pipelines for Marine and Life Sciences occupations are sustainable. Nationwide, as the Baby Boomer generation retires there will be worker shortages in occupations that do not have enough younger workers to replace these impending retirees. Of all the selected Marine Sciences occupations in the Tampa Bay region, only three have a higher percentage of workers between 25 and 44 than of workers 45+: environmental engineers, microbiologists, and hydrologists. The rest are at risk of not having adequate workers to replace impending retirees and to fill demand as the sector continues to grow. In Life Sciences, those at risk are medical and health services managers, chemists, medical and clinical laboratory technologists, and medical and clinical laboratory technicians.

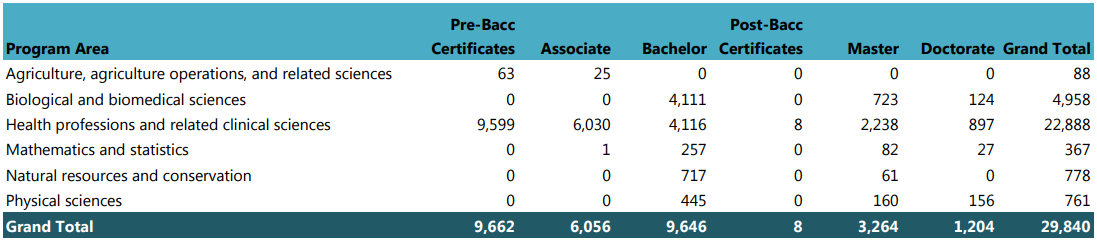

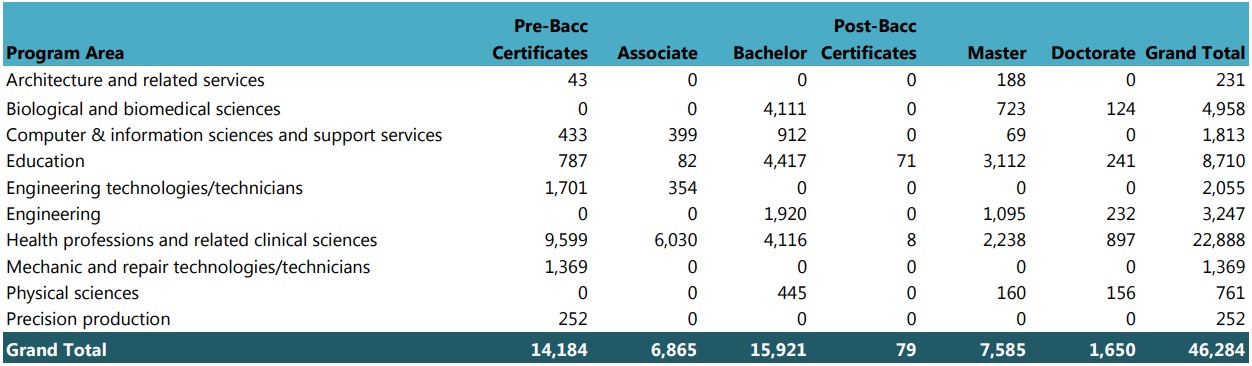

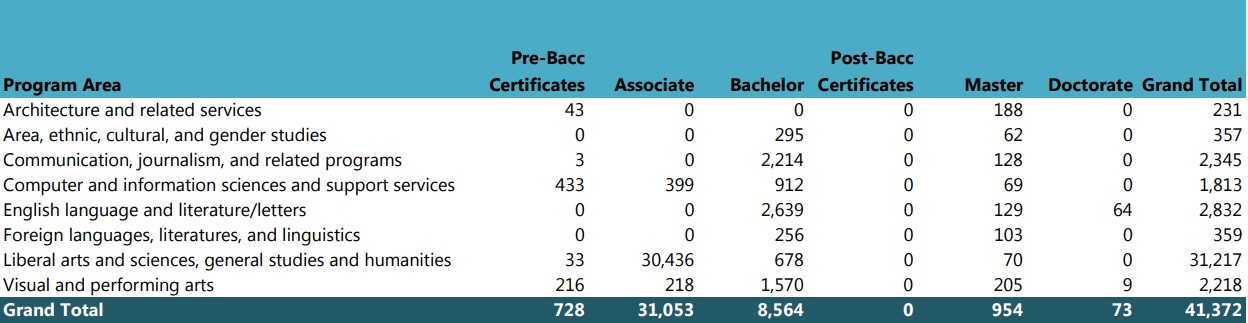

DEGREE PIPELINE, 2008-2012

Source: NCES

Note: These totals include degrees conferred at all public and private, non-profit colleges and

universities within a 25 mile radius of St.

Petersburg. For a full list of institutions, see the Competitive Assessment.

Educational Capacity: Between 2008 and 2012, there has been a gradual increase in the number of health and biological sciences degrees granted from the associate level to the doctorate level at universities within a 25 mile radius of St. Petersburg. The largest program areas represented are health professions and related clinical sciences as well as biological and biomedical sciences. While prebaccalaureate certificates and bachelor’s degrees are the most numerous levels of degrees supporting this target that are conferred in and around the city, it is interesting to note that nearly a quarter (24.3 percent) of total master’s degrees and well over half (59.8 percent) of doctorate degrees conferred at the selected institutions of higher learning are in program areas that support the Marine and Life Sciences cluster. As with other targets, companies with occupational needs will be able to take advantage of the full regional workforce capacity.

City residents interested in pursuing a career in Marine and Life Sciences have access to several relevant training programs. Secondary and higher educational programs and partnerships include:

- USFSP’s College of Marine Science: Graduate programs are offered for biological oceanography, chemical oceanography, geological oceanography, physical oceanography, and marine resource assessment. In addition, USFSP has programs in environmental science and policy, with concentrations in environmental policy, environmental science, environmental sustainability, and geospatial science.

- USF-Tampa’s College of Engineering: Relevant programs include bachelor’s, master’s, and doctorate programs in civic and environmental engineering and in chemical and biomedical engineering.

- USF-Tampa’s Patel College of Global Sustainability: The Master of Arts in Global Sustainability has four concentrations: water, entrepreneurship, sustainable tourism, and sustainable energy. For hands-on learning, students in this graduate program have access to internships across the world

- USF-Tampa’s Center for Entrepreneurship: Both the Tampa and St. Petersburg campuses of USF have nationally ranked and award-winning entrepreneurship programs. However, one graduate program in particular, located on the main campus, adds tremendously to the needs of the Marine and Life Sciences target: the master’s program in entrepreneurship in applied technologies. This program’s curriculum focuses on technology and market assessment, product commercialization, new venture formation, and new venture financing. This degree can also be pursued alongside aforementioned graduate degrees.

- USF-Tampa/Draper Laboratory Fellow Program: A partnership with Draper Laboratory and the University of South Florida, as well as universities in Boston, MA and Houston, TX, each year 50-60 graduate students are selected through a Research Assistant position with the school. The program covers the cost of full tuition and provides a monthly stipend while the student works in collaboration with a Draper technical staff member on a project that can serve as a thesis project and help advance Draper research.

- St. Petersburg College: The college offers an associate’s degree in Environmental Science Technology.

- At its St. Petersburg Campus, Pinellas Technical Education Centers (pTEC) offers full-time and partiallyonline programs in Surgical Technology

- Eckerd College: The college offers undergraduate programs in biochemistry, geosciences, marine biology, marine chemistry, marine geology, and marine geophysics.

Since a comprehensive talent pipeline begins training its future homegrown talent early, K-12 programs that support the target are important as well. There are several means by which students are exposed to Marine Sciences at an early age and hopefully directed to further training opportunities in the region and exposed to potential future job opportunities in their hometown.

- Lakewood High School Academy for Aquatic Management Systems and Environmental Technology: The Pinellas County School District has instituted career academies in each of its high schools. Lakewood High School, located in St. Petersburg, has a career academy that directly supports the Marine Sciences niche. Students enrolled in this academy receive special training in ecology, environmental sciences, marine biology, agroponics, and water resource conservation. The campus includes a two-acre outdoor classroom with a natural spring-fed pond

- Canterbury School of Florida Marine Studies Program: The first Cousteau Divers partner school in the world and the only one of its kind in the U.S., the St. Petersburg private school’s Marine Studies program educates students ages 3 to 18 about environmental conservation. The 2,800 sq. ft. Cousteau Center for Marine Studies consists of classroom and laboratory space, providing students with interactive learning opportunities through aquarium touch tanks, a kayak fleet, and a 23-foot Sea-Pro bay boat.

PLACE-BASED ASSETS

Port of St. Petersburg: The city of St. Petersburg’s geographic location on a peninsula bordering the Gulf of Mexico and Tampa Bay is a clear asset that supports its strength in Marine Sciences. The city’s downtown waterfront is not only a major quality of life amenity, but also an economic driver and research site. A reportedly underused asset along the waterfront is the Port of St. Petersburg, which is in close proximity to the adjacent Alfred Whitted Airport and the aforementioned downtown research district, a significant competitive advantage. With the presence of SRI International’s 35,000 square foot facility already at the port focused on developing technology related to ocean science, maritime industry, and port security and existing research vessels owned by the Florida Institute of Oceanography supporting numerous state and federal agencies, the Port of St. Petersburg is ripe for attracting more marine science and oceanography research vessels, an opportunity supported by Mayor Rick Kriseman. Earlier this year, city officials approved the installation of six electric power pedestals ideal for research vessels.2 A challenge related to expanding a research presence at the Port of St. Petersburg is a ten-year maximum lease period for entities located in the district. Previous referendums in 2004 and 2011 to extend the lease term were defeated.

Downtown Research District: The downtown research district is another key asset for this target. The concentration of target-related jobs and research activity in Downtown St. Petersburg is a magnet for other researchers and marine science professionals looking for the human capital and connectivity that such a district provides. In addition to the firms and research organizations mentioned earlier, this district is also home to the University of South Florida St. Petersburg campus, Secrets of the Sea Marine Exploration Center and Aquarium (formerly the Pier Aquarium), the U.S. Coast Guard Sector St. Petersburg, USF’s Center for Ocean Technology, and many others. This corridor is close in proximity to All Children’s Hospital, Bayfront Family Health Center, and Kindred Hospital, creating a natural physical connection to the Life Sciences niche.

Research and specializations: All Children’s Hospital is a member of the Johns Hopkins Health System and is the first U.S. hospital outside of the Baltimore and District of Columbia region to be affiliated with John Hopkins. In expanding the hospital’s capacity, the hospital has added a pediatric residency program, which will welcome its first class in July 2014, as well as a pediatric surgical fellowship, which provides exposure to both general surgery and to specialized areas, such as oncology and congenital anomalies, which lends to research areas for doctors. Currently, the hospital conducts approximately 300 clinical research studies, over half of which are clinical trials.

The Children’s Research Institute (CRI) is located on the St. Petersburg campus of the University of South Florida, east of All Children’s Hospital, on land donated by the city of St. Petersburg. The CRI consists of 48,000 square feet that includes in excess of 35,000 square feet of laboratories, faculty offices and support space. CRI laboratories house the research programs of the holders of endowed chairs in immunology, cardiology, neonatology and other subspecialties.

Bayfront Family Health has several areas of specialty within its delivery of health care services, including perinatal intensive care, heart care, orthopedic surgery, adult and pediatric trauma, neurosciences, with focus in neuro-imaging and interventional neuroradiology, and robotic surgery.

In terms of university research capacity, the University of South Florida College of Marine Science is a key asset for the city. According to the city of St. Petersburg’s Economic Development Department, the College of Marine Science attracts $27 million per year in research funding and has 13 marine science labs as well as four ocean modeling systems. In 2011, Eckerd College’s Marine Science department received a National Science Foundation grant of nearly $1 million to enhance research facilities within the Galbraith Marine Science Laboratory. The renovations supported next-generation research programs of Eckerd faculty, with enhancements to labs for the following research areas: molecular biology and biochemistry, scientific imaging and neurophysiology.

In terms of patent production, 9.7 percent of the patents, or a total of 422, originating in the Tampa MSA between 2000 and 2011 were related to drug, bio-affecting and body treating compositions (207 patents), molecular biology and microbiology (65), ships (41), animal husbandry (23), hydraulic and earth engineering (21), marine propulsion (17), analytical and immunological testing (13), chemistry of radiation imagery (10), buoys, rafts, and aquatic devices (9), chemistry of inorganic compounds (8), multicellular living organisms (7), and chemistry of hydrocarbon compounds (1). In fact, 20 percent of all radiation imagery patents and drug, bio-affecting and body treating compositions patents in the state originated in the Tampa MSA.

Synergy between niches: Because of the similarities between the human body’s composition and characteristics of the sea and ocean, researchers are making increased connections between human physiology and disease management and marine organisms and habitats. In addition to the potential applications of knowledge stemming from the “warm, salty, wet” similarity between the ocean and the human body, researchers have noted that the ocean remains widely untapped of the rich possibilities of plant and animal life that may be used for health purposes. Integrated research can potentially lead to the development of pharmaceuticals and other treatments. With researchers in both fields located in such close geographical proximity to each other in the downtown research district, this could be a major opportunity for a third niche in the city’s Marine and Life Sciences target.

BLUE Ocean Film Festival: Events such as the BLUE Ocean Film Festival provide an invaluable platform to market St. Petersburg and its vast assets to large audiences. The week-long BLUE Ocean event in November 2014 will reach approximately 20,000 filmmakers and scientists – all potential future St. Petersburg residents and workers – during its three-part program, which includes a film festival featuring finalists from all over the world, an industry conference highlighting ocean issues and underwater filmmaking technical information, and a conservation summit to share and debate various scientific issues. Economic development partners should work together to use platforms as significant as BLUE Ocean to ensure that St. Petersburg leaves an indelible impression.

STRATEGIC COMPONENTS

Economic developers can support growth in Marine and Life Sciences by focusing on both the target’s two niches and also the integrated opportunities between them. As with all targeted sectors, one of the most important competitive concerns is workforce capacity. Developers can work with training providers to not only bolster existing programs but also identify gaps in the talent pipeline by focusing on graduate placement and talent retention. With so many assets in this target co-located in the same district, the developer’s job becomes optimizing the infrastructure and business climate in the Port of St. Petersburg and downtown burgeoning innovation district. This includes addressing lease-length issues, available space for growth, aesthetic and walkability factors, and research and incubation capacity. Marketing will also be important to promote the opportunities of the emergent cluster and attract firms focused on livingsystems research and development.

Alignment with city targets: Of the seven business clusters the city of St. Petersburg has identified as most important to the city’s economy, two are aligned with the Marine and Life Sciences target: Marine and Environmental Sciences and Medical Technologies and Life Sciences. The Marine and Environmental Sciences cluster corresponds closely to the Marine Sciences niche presented in this report. The Medical Technologies component of the Medical Technologies and Life Sciences cluster syncs with the Specialized Manufacturing target, while the Life Sciences portion, which includes research, medical care specializations, and pharmaceutical production, sync with the Life Science niche.

Alignment with county targets: Pinellas County Economic Development (PCED) has six targeted industries. Its Life Sciences & Medical Technologies target is closely aligned with the Life Sciences niche of the Marine and Life Sciences target and could also be an appropriate fit for the innovation resulting from the synergies between marine science and life science research and development. According to PCED, nearly half of all life sciences companies in the Tampa metro area are located in Pinellas County.

Alignment with regional targets: It is always important to leverage existing economic development efforts when possible to reduce redundancy and to maximize local resources. Two of the Tampa Bay Partnership’s targeted business clusters overlap with the Marine and Life Sciences target: Marine and Environmental Activities and Applied Medicine and Human Performance. The Marine and Environmental Activities cluster for the region focuses on the commercialization of research and innovation in the region, an important next step for St. Petersburg as well. Applied Medicine and Human Performance (which also aligns with the next target, Specialized Manufacturing) covers health and biosciences sectors, including biomedical research and clinical trials, which are vital to the Life Science niche in St. Petersburg.

Alignment with state targets: Enterprise Florida, the official economic development organization for the state of Florida, has two target industries that sync with the Marine and Life Sciences cluster: Cleantech and Life Sciences. Cleantech focuses on clean energy and environmental sustainability. Within this focus area is a niche in Water, Air, and Environment, with research in water testing, reverse osmosis and desalination, bioremediation, and environmental monitoring, which all align with St. Petersburg’s Marine Sciences niche. The Life Science target stems from Florida’s position as the nation’s third largest pharmaceutical manufacturing market and the eighth largest biotech research and development sector.

Specialized Manufacturing

While many laypeople think that manufacturing is disappearing as an American employment sector, the opposite has been the case since the close of the Great Recession. Rebounding from years of decline, U.S. production employment has been a bright spot in recent years as a confluence of factors including rising costs overseas, improved productivity and innovation stateside, and a growing global demand for goods has reinvigorated the national manufacturing sector. New technologies such as additive manufacturing (often known as 3-D printing) have reduced barriers to entry in manufacturing and created a brand-new entrepreneurial economy for “makers” of things big and small.

Manufacturing has long been a top employment sector in Pinellas County and St. Petersburg. Continuing local strength in production jobs is clearly demonstrated in location quotient data for the community’s most concentrated manufacturing subsectors. Market Street proposes that the two largest and most competitive production subsectors in St. Petersburg comprise the niches of a Specialized Manufacturing target. Electronics and Medical Devices are both legacy subsectors for the city and share needs related to production-oriented worker skill sets, competitive taxation and incentive climates, site and building needs and constraints, and potential export strategies. As with Marine and Life Sciences, the niches of Specialized Manufacturing will be developed with specific supportive actions, but strategies that can improve St. Petersburg’s position for advanced manufacturing as a whole will also be pursued. The term “specialized” is important because it acknowledges that one way U.S. manufacturers can remain competitive against lowercost countries is by innovating and remaining ahead of the global development curve. Along the same lines, American communities can remain competitive for manufacturing jobs by focusing on the development of specialized skill sets to support this innovative, value-added production that remains ahead of the global development curve.

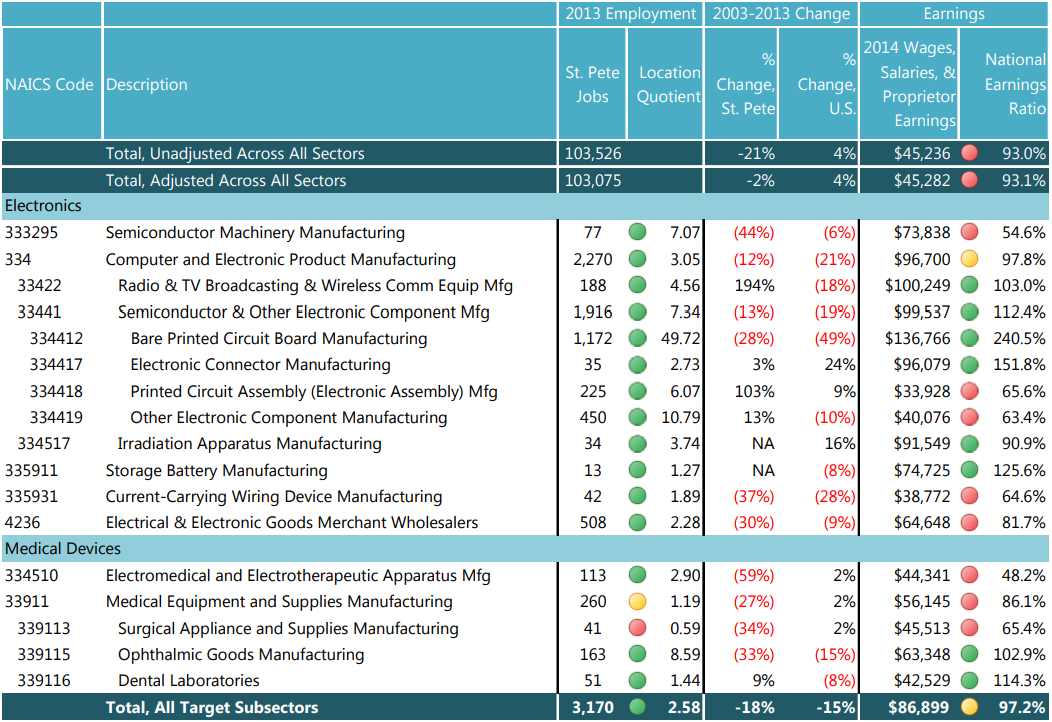

SUBSECTOR PERFORMANCE

St. Petersburg’s Specialized Manufacturing target is comprised of two niches: Electronics and Medical Devices. Electronics manufacturing covers an array of subsectors from merchant wholesalers to semiconductor machinery to various types of electronic components used to develop other products and includes Jabil, one of the city’s largest employers. Medical Devices manufacturing focuses on the creation of medical equipment and supplies, which has synergies with the Electronics niche because of some of the technologies leveraged to treat medical issues as well as skills sets and occupations key to both. With very strong concentrations across the board within this target and high average wages, Specialized Manufacturing is clearly a burgeoning cluster for the city of St. Petersburg. However, with sluggish growth projected nationwide for many electronics subsectors, coupled with extreme competition for medical technology manufacturing, the city will need to leverage all available regional and state resources to maximize the target’s potential growth and development.

Data show that St. Petersburg’s Specialized Manufacturing target is becoming more than a group of similar subsectors and is developing into an impactful cluster. Employment concentrations often are the principal indicator demonstrating the clustering of a local employment sector. In the city of St. Petersburg, Specialized Manufacturing has an overall location quotient of 2.58. The Electronics niche has the highest levels of concentration compared to the nation, including bare printed circuit board manufacturing (LQ = 49.72), other electronic component manufacturing (10.79), semiconductor machinery manufacturing (7.07), printed circuit assembly manufacturing (6.07), and radio and television broadcasting and wireless communication equipment manufacturing (4.56). Within the Medical Devices niche, the subspecialties are ophthalmic goods manufacturing (8.59) and electromedical and electrotherapeutic apparatus manufacturing (2.90). Ophthalmic goods include prescription eyeglasses, contact lenses, reading glasses, and other types of protective and magnifying eyewear. Electromedical and electrotherapeutic apparatus refers to medical electrical devices such as imaging equipment, ultrasound equipment, pacemakers, hearing aids, and the like.

EMPLOYMENT TRENDS, SPECIALIZED MANUFACTURING TARGET

Source: EMSI

Note: National Earnings Ratio Color Code based on Tampa MSA Cost of Living Index of 93.2

The Specialized Manufacturing target did take a hit during the recession, but losses are only slightly greater than the national average and many St. Petersburg subsectors actually outperformed their U.S. equivalent. Prior to the Great Recession (from 2003 to 2007), only four sectors experienced employment loss: bare printed circuit board manufacturing, electronic connector manufacturing, printed circuit assembly manufacturing, and ophthalmic goods manufacturing—all still very concentrated subsectors despite losses. In 2007, several subsectors began to experience employment loss, with recovery still sluggish as sectors continue to shed jobs. However, in several subsectors, particularly radio and television broadcasting and wireless communication equipment, printed circuit assembly, other electronic components, and bare printed circuit board manufacturing, St. Petersburg outperformed the nation.

Key firms supporting this target include but are not limited to:

- Jabil is a well-respected major employer headquartered in St. Petersburg and is the second largest company in the Tampa Bay region. In addition to corporate functions, the global electronics manufacturing services firm also has manufacturing functions, most notably the assembly of printed circuit boards, aftermarket services, and a research and design center in the city.

- Elreha Printed Circuits Boards, established in St. Petersburg, is a manufacturer of printed circuit boards for automotive, commercial, and military applications.

- Plasma-Therm is a leading global supplier of semiconductor equipment. The firm manufactures advanced plasma processing equipment and has R&D operations.

- Tricom Technology develops fiber optic and networking equipment for telecommunication, industrial, and military applications.

- Sensitive Technology is a leader of electronics components distribution.

- General Electric Medical Systems has a branch in St. Petersburg that develops electromedical equipment. The global company has expertise in many areas including medical imaging, medical diagnostics, and patient monitoring systems.

- Aurora Surgical has connected instrument sculptors to ophthalmic surgeons to develop ophthalmic surgical instruments.

- IcareLabs was ranked in 2012 by Vision Monday as the fifth largest independently owned prescription eyewear manufacturer in the nation. This optical lab uses state-of-the-art technology to develop a wide range of lenses with greater levels of precision and efficiency.

- MTS Medication Technologies, owned by Omnicell, is headquartered in St. Petersburg, FL and is an international provider of medication adherence packaging systems related to medication dispensing and administration.

Average annual wages for Specialized Manufacturing are high compared to the citywide average wage and the national average by subsector, especially when cost of living is taken into account. Only a few subsectors have average annual wages lower than the adjusted city average of $45,282. Because of classification issues that arise when companies are engaged in multiple business activities, some of the average wages from the previous table likely include the salaries of C-level executives. For instance, one of Jabil’s main classifications is NAICS 334412 Bare Printed Circuit Board Manufacturing. Because Jabil is a headquarters, corporate employment is included along with engineering and production employment in employment and wage estimates, leading to higher averages.

As a burgeoning cluster, Specialized Manufacturing’s strength is further demonstrated by its output of exports. This target generates a total of $843 million in exports, or 7.7 percent of the city’s total. The percentage of city exports generating from this target is nearly three times than the percentage of state exports generating from these subsectors, only 2.9 percent. The subsectors with the greatest volume of exports are bare printed circuit board manufacturing, with $380 million in exports, and other electronic parts and equipment merchant wholesalers, with $104 million in exports.

The St. Petersburg market leads the state in exports of two subsectors: bare printed circuit board manufacturing and semiconductor machinery manufacturing. Of the $481 million of bare printed circuit board manufacturing product exported from the state of Florida, 78.9 percent is generated in St. Petersburg. Similarly, of the $23.4 million of semiconductor machinery manufacturing product exported from the state of Florida, 78.6 percent originates in St. Petersburg.

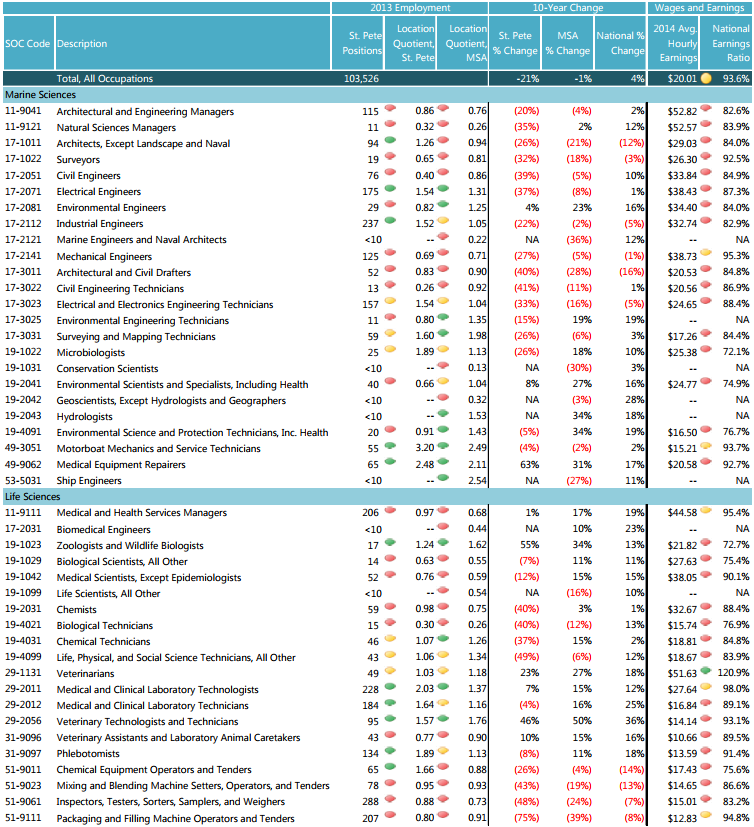

OCCUPATION TRENDS

Analysis of the data in the following chart provides insight into the talent requirements of the city’s Specialized Manufacturing target as well as average hourly wages for these specific occupations. A handful of occupations span both niches; this not only supports the bundling of these sub-sectors under the broader target but provides a competitive advantage by providing a larger labor pool for companies in each specialization.

OCCUPATIONAL STATISTICS, SPECIALIZED MANUFACTURING TARGET, 2013

Source: EMSI

Note: National Earnings Ratio Color Code based on Tampa MSA Cost of Living Index of 93.2

The city of St. Petersburg surpasses the region in concentrations of many of the relevant occupations for Specialized Manufacturing despite greater losses over time compared to national trends. These losses are partially due to effects of the Great Recession. One example is Jabil, which had plans to invest in a new headquarters and manufacturing plant before the recession but ended up laying off approximately 500 workers over a three-year period. Jabil remains a major employer, however, and has since revisited its plans for new headquarters space in St. Petersburg.

Many Specialized Manufacturing occupations offer competitive wages as compared to the city average hourly wage of $20.01, particularly those requiring associate and bachelor’s degrees or higher. Even so, certain positions offer wages lower than the city average. It is important to note, however, that St. Petersburg’s diverse occupational composition is an asset—workers of various skill levels have opportunities for employment within this target and companies are provided with a deep breadth of potential workers for multiple positions.

Projected Workforce Gaps: Potentially crippling workforce sustainability issues are present acrossthe-board for Specialized Manufacturing occupations in the Tampa Bay region. Only four targeted occupations featured in this analysis have a greater percentage of workers aged 25-44 than those aged 45+: systems software developers, helpers of electricians, electricians, and packaging and filling machine operators and tenders.

The occupations at greatest workforce sustainability risk are production positions: electromechanical equipment assemblers; coil winders, tapers, and finishers; electrical and electronic equipment assemblers; and machinists. While talent retention and connecting graduates from SPC to local employers will be important tactics to ensure that impending retirees will have replacements in the future, it is important to note that the limited local capacity for four-year training opportunities is a constraint that may possibly exacerbate worker shortages.

Educational Capacity: This target is supported by a diverse mix of occupations requiring an array of skill levels: engineers, software developers, and technical and scientific sales representatives require bachelor’s degrees or higher; drafters, technicians, and processors require associate degrees; and mechanics, machinists, and other production positions require certificates and/or provide various levels of on-the-job training.

DEGREE PIPELINE, 2008-2012

Source: EMSI

Note: These totals include degrees conferred at all public and private, non-profit colleges and

universities within a 25 mile radius of St.

Petersburg.

While there are educational opportunities within the region to support the Specialized Manufacturing target, there is a clear lack of local degree-gaining capacity at the bachelor’s level and higher to prepare workers for the thousands of jobs in this sector in St. Petersburg. St. Petersburg College is a key asset for local training of technicians, assemblers, and other production workers.

- St. Petersburg College: Students have local access to associate degree and certificate programs in drafting and design, engineering technology, technology development and management, computer programming and analysis, and orthotics and prosthetics technology, which also has a bachelor’s degree program.

- At its St. Petersburg Campus, pTEC has a full-time program in Applied Welding Technologies.

- USF-Tampa College of Engineering: Still within a reasonable drive, students do have access to the bachelor’s, master’s, and Ph.D. programs at the main campus of the University of South Florida in the following relevant majors: computer science and engineering, electrical engineering, industrial and management systems engineering, mechanical engineering, and information technology.

- USF-Tampa Center for Entrepreneurship: Similar to the Marine and Life Sciences target, the master’s program in entrepreneurship in applied technologies should be leveraged in connecting the dots involved in bringing innovative technologies to market. Technology and market assessment, product commercialization, new venture formation, and new venture financing are integrated in the program’s curriculum. This degree can also be pursued alongside aforementioned graduate engineering degrees.

Pinellas County School District has career academies that support the Specialized Manufacturing target; however, the high schools these academies are housed in are not located in the city of St. Petersburg.

- East Lake High School Academy of Engineering (in Tarpon Springs): Students in this academy are introduced to engineering, aeronautical engineering, computer-integrated manufacturing, digital electronics, principles of biotechnology engineering, civil architecture, and engineering design and development.

- Countryside High School Institute for Science, Technology, Engineering and Mathematics (ISTEM) and Center for Computer Technologies (in Clearwater): The Institute for Science, Technology, Engineering, and Mathematics is a college preparatory program with a specific emphasis on research, innovation, and technology. Students learn about and apply emerging technologies, are required to complete Advanced Placement or college dual enrollment courses, and have opportunities to receive certifications in cyber security, database programming, and digital video and multimedia. The Center for Computer Technologies teaches students computer repair and hardware and software troubleshooting, and students have opportunities to receive certifications in various computer-related fields.

A new addition to the training pipeline within the Pinellas County School District is Azalea Middle School’s Middle Grades Engineering Gateway to Technology (GTT) in St. Petersburg where students are introduced to problem-solving through the design process and provided with a solid foundation for continued science, technology, engineering, and mathematics.

PLACE-BASED ASSETS AND OPPORTUNITIES

Availability of commercial/industrial space: St. Petersburg suffers from a lack of the large-acreage sites, generally required by manufacturers. Favorable sites can be as large as several hundred acres or more, have highway access, can accommodate production buildings, approach roads, and other specific infrastructure components. Because of the shortage of available land in the city, St. Petersburg will need to take advantage of brownfield and grayfield sites and opportunities to retrofit and redevelop unused or underused existing properties to accommodate large manufacturers. However, there are also opportunities for St. Petersburg to leverage light industrial space and mixed-use developments since many small to medium size manufacturers in this target may not need the massive space that larger manufacturers do.

Research capacity: A sizable percentage of the region’s patents are related to electronics and medical devices. Between 2000 and 2011, 28.2 percent of all patents, or 1,221 total patents, produced in the Tampa MSA were related to innovation in these niche areas. The largest technology areas for patent production related to the electronics niche were electrical communications (90 patents over the 11-year period), pulse or digital communications (81), multiplex communications (67), telephonic communications (50), electrical connectors (44), electrical systems and devices (41), and semiconductor device manufacturing (32). In the area of medical devices, the largest technology classes were surgery related to radioactive substances and radiant energy waves (144), surgical instruments (103), surgical medicators and receptors (90), prosthesis (58), optics measuring and testing (39), optical systems and elements (26), and light, thermal, and electrical surgical applications (25).

Pro-business state/incentives: Analysts have found Florida to be an attractive place for manufacturers because of its favorable business tax structure and incentive programs, competitive costs, and right-towork status. A new law, effective April 30, 2014, features the elimination of the manufacturing and equipment sales tax, a top legislative priority for Governor Rick Scott. Enterprise Florida estimates that the elimination will result in $141 million of tax savings for the over 18,000 manufacturers in the state and will make the state more competitive when compared to other states that do not levy this tax.

STRATEGIC COMPONENTS

In what will become a recurring theme of this report and the Grow Smarter Strategy, the most impactful action economic developers can perform to support Specialized Manufacturing is to ensure that the sector’s supply of trained, qualified talent is sustainable. As projected workforce gaps in this target foretell, the retirement of older workers in local production jobs will create a critical shortage of workers to support the city’s Specialized Manufacturing cluster. With limited land available for new large-scale production operations, St. Petersburg’s growth in this target will be concentrated in existing businesses and small-scale operations. Thus, a best-in-class business retention and expansion (BRE) program as well as support for nascent yet promising production firms will be important strategies to pursue. Likewise, exposing existing manufacturers to new markets and customers can also help drive local growth.

Alignment with city targets: The city of St. Petersburg’s existing Medical Technologies and Life Sciences and Manufacturing business clusters have overlapping components with the Specialized Manufacturing target. The Medical Technologies component of the cluster corresponds with the Medical Devices niche, while the Manufacturing cluster is more expansive than the Specialized Manufacturing target but includes the development of products relevant to this target, including micro-electronics, lasers, medical devices, computer components, and printed circuit boards.

Alignment with county targets: Pinellas County Economic Development’s Advanced Manufacturing target is broader than the Specialized Manufacturing target, but it includes both electronics and medical devices as specific focus areas. Specialized Manufacturing is also aligned with the Medical Technologies component of the County’s Life Sciences and Medical Technologies target. The County is an important resource for workforce development programs and financing and investment tools.

Alignment with regional targets: The Tampa Bay Partnership has identified High-Tech Electronics and Instruments as one of its four targeted business clusters. This cluster is composed of both manufacturers and research and development companies, and the cluster’s three niches are defense and avionics, medical devices, and marine instruments. Businesses in St. Petersburg can join a variety of industry and professional organizations who have joined together to form the Tampa Bay Advanced Manufacturing Consortium. The region’s focus on research connectivity and workforce development should be leveraged as the city works to gain a better position in both of these areas.

Alignment with state targets: Enterprise Florida has two target industries that align with St. Petersburg’s Specialized Manufacturing target: Manufacturing and Life Sciences. Four subsectors important to the city’s target are in Florida’s list of top 20 manufacturing segments: medical equipment and supplies (second largest in terms of employment), semiconductor and electronic components (4th), electronic instruments (5th), and communications equipment (13th). Florida’s Life Sciences target overlaps Manufacturing in medical device manufacturing. According to Enterprise Florida, the state of Florida has the second largest medical device manufacturing market in the country. Leveraging state resources and exposure will be important to continuing the clustering of relevant businesses.

Financial Services

Though, as the recent recession demonstrated, Financial Services is often a cyclical sector with fortunes tied to national and global economic trends, it is nevertheless a stable economic driver over the long term as consumers and businesses – who continue to grow in numbers globally – need access to credit and forms of risk mitigation (insurance). This is especially true in the city of St. Petersburg, which features one of the most concentrated Financial Services sectors in the state of Florida. Thousands of city residents are employed by local firms and are paid wages above the local average. Because, as data in this section will show, Financial Services is also a major exporter for St. Petersburg, these positions are also creating dynamic “multiplier effects” across the local economy creating even more jobs and wealth for local residents.

Benefitting from talent attraction and retention advantages inherent in St. Petersburg’s high quality of life and the presence of multiple regional training institutions, Financial Services is the city’s largest employment sector and has reached the critical mass needed to be categorized as a true cluster. Market Street has recommended that the sector be divided into three separate but related niches that engage in different business processes and require varying skill sets but share business-climate conditions.

SUBSECTOR PERFORMANCE

The Financial Services target, with its significantly high employment concentrations across nearly all subsectors, higher-than-city-average wages, and Raymond James as a magnet for talent, is a definitive cluster in St. Petersburg. The city has three distinct niches of targeted employment activity: Security and Asset Management, Insurance, and Customer Care. While engaged in different financial processes and support dynamics, the niches nevertheless are complementary, coming together to provide customers with full-service wealth management, planning, and shared-services support. Security and Asset Management encompasses the investment and commercial banking aspects of a customer’s wealth portfolio, while Insurance includes products for long-term financial planning. The Customer Care niche includes financial transactions processing, customer care centers, and shared services such as sales and payment services.

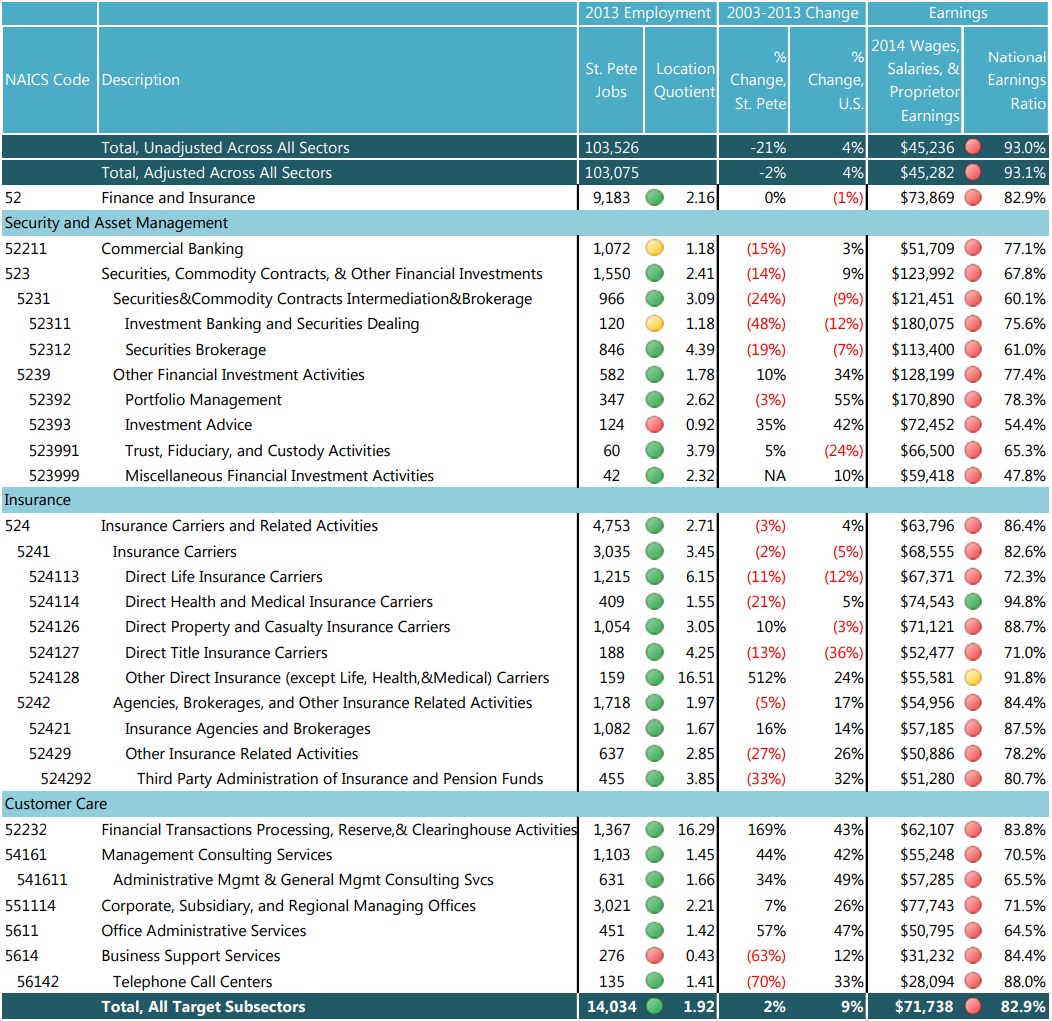

EMPLOYMENT TRENDS, FINANCIAL SERVICES TARGET

Source: EMSI

Note: National Earnings Ratio Color Code based on Tampa MSA Cost of Living Index of 93.2

Employment in the finance and insurance sectors (NAICS 52) is nearly twice as concentrated in the St. Petersburg economy as the average American community (LQ=2.16). By comparison, Mecklenburg County, North Carolina – home to Charlotte, a community that is widely considered the financial capital of the South – possesses a location quotient of 2.11. This underscores the degree to which St. Petersburg is reliant on Financial Services as an economic engine. The most concentrated Financial Services sectors in the city are other direct insurance (LQ = 16.51), financial transactions processing, reserve, and clearinghouse activities (16.29), direct life insurance carriers (6.15), securities brokerage (4.39), third party administration of insurance and pension funds (3.85), trust, fiduciary, and custody activities (3.79), securities, commodity contracts, intermediation, and brokerage (3.09), and direct property and casualty insurance carriers (3.05).

Financial Services is the source of thousands of high-paying local jobs. Average annual wages are much higher the city average. However, across the board, even when cost of living (93.2) is considered, these wages are much lower than the national average—as low as 54.4 percent of the U.S. figure. This could present a challenge in terms of both talent retention and attraction. While St. Petersburg has a highly regarded quality of life and a lower cost of living, wages can still be a major consideration for workers, who have become increasingly more mobile.

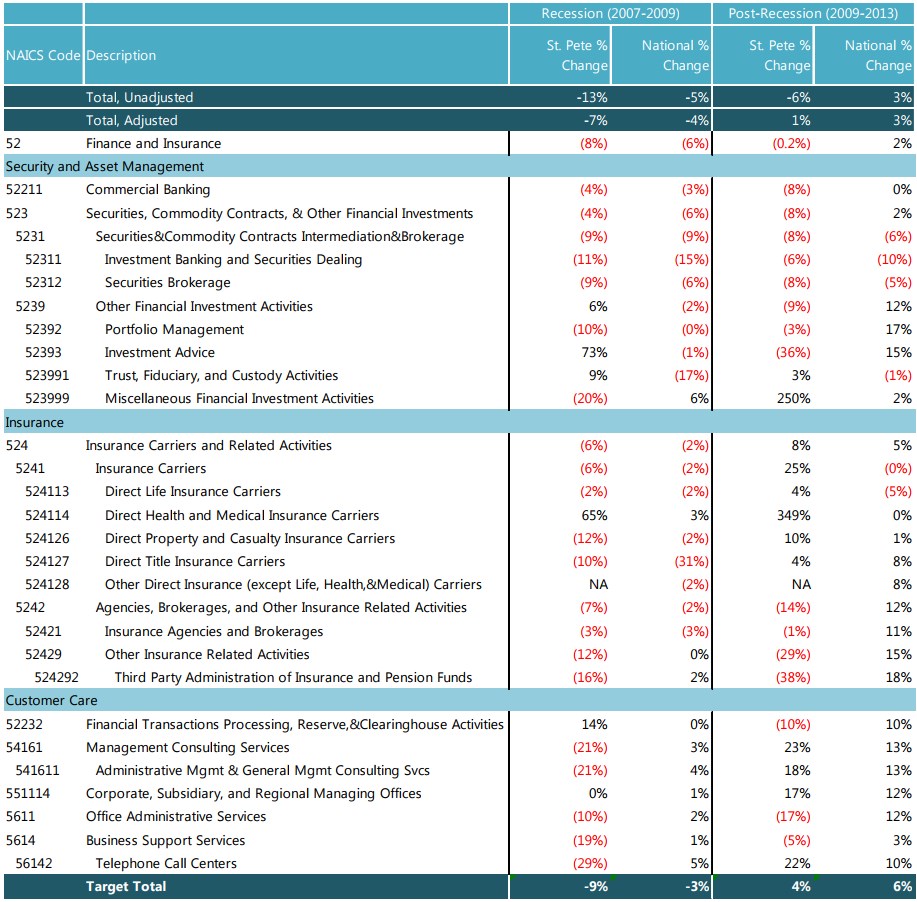

The Great Recession had significant adverse effects on financial services-related sectors nationwide. From 2007 to 2009, the nation lost six percent of its Finance and Insurance jobs (NAICS 52), not including the Customer Care subsectors, which performed well during the recession. Subsectors affected most severely nationwide were direct title insurance carriers (a loss of 31 percent between 2007 and 2009), trust, fiduciary, and custody activities (-17 percent), and investment banking and securities dealing (-15 percent). In St. Petersburg, employment losses were slightly more pronounced, with an eight percent loss of jobs in Finance and Insurance jobs between 2007 and 2009 along with three percent of Customer Care jobs. Finance and Insurance subsectors most adversely impacted include miscellaneous financial investment activities (a loss of 20 percent in the recessionary years) and third party administration of insurance and pension funds (-16 percent). It is interesting to note that while St. Petersburg did take a harder hit overall in Finance and Insurance employment, these were concentrated in the aforementioned subsectors. The remaining local subsectors outperformed the nation during the recession, likely buffered by the large presence of headquarters firms.

RECESSIONARY EMPLOYMENT TRENDS, FINANCIAL SERVICES TARGET

Source: EMSI

Each Financial Services niche is supported by numerous major employers. The following list represents only a fraction of the target’s firms in St. Petersburg.

- Raymond James Financial is not only a top employer in the Security and Asset Management niche include but also a top firm in St. Petersburg as well as the Tampa Bay region. Headquartered in St. Petersburg, the financial services firm has a major presence all over the world. Raymond James is a leader in financial planning, wealth management, and investment banking, and it also contributes to the Customer Care niche.

- Transamerica is headquartered in St. Petersburg and has subsidiary entities that support all three niches. A national company, Transamerica provides investment services and insurance products to its more than 19.5 million customers.

- Franklin Templeton Investments has extensive presence globally with offices in 35 countries. The investment firm serves both individual customers as well as firms and other institutions.

- Castle Key Insurance Company and Castle Key Indemnity Company are both subsidiaries of Allstate and are among the largest property insurers in the country. Both have major offices in St. Petersburg.

- In 2013, American Strategic Insurance, also a property and casualty insurer, opened a new headquarters location in the city as a component of a 13-acre, $42 million project. Several insurance companies in the city of St. Petersburg operate processing centers, which also contribute to the Customer Care niche.

Although the firms of the first two niches support the Customer Care subsector as well, the city of St. Petersburg features employers who focus specifically on financial transactions processing, shared services, and other forms of customer interaction and assistance.

- One such employer is PSCU, which provides traditional and online financial services to credit unions. PSCU is headquartered in St. Petersburg and operates one of its four Contact Centers in the city, performing 24/7/365 member servicing, sales, lending, collections, and cardholder support.

- FIS has a regional e-banking and e-payments facility and a print and mail processing center for customer communications in St. Petersburg. FIS is the result of the 2006 merger between the then-named firm Fidelity Information Services and the St. Petersburg-based Cetergy, which specialized in services such as loyalty programs, electronic bill payment services, stored-value cards and processing, and other functions. FIS, having gained these specialties, is now a leading firm in financial services technology.

Although exports are generally thought of as tangible goods and products, services can be exported as well, as is the case for St. Petersburg’s Finance and Insurance target, a major exporter for the city. An example of service exports is a St. Petersburg company providing underwriting and actuarial services, account management, or collection management to a company in another state. In 2011, the Financial Services target in the city of St. Petersburg generated $2.2 billion in exports, the largest private-sector export sector in the city, even greater than manufacturing ($1.5 billion). This further supports the notion that Financial Services is a solid cluster in St. Petersburg. Leading subsectors for exports encompass all three niches: corporate, subsidiary, and regional managing offices ($395 million), financial transactions processing, reserve, and clearinghouse activities ($382 million), direct life insurance carriers ($247 million), portfolio management ($171 million), securities brokerage ($164 million), direct property and casualty insurance carriers ($131 million), and commercial banking ($97.7 million).

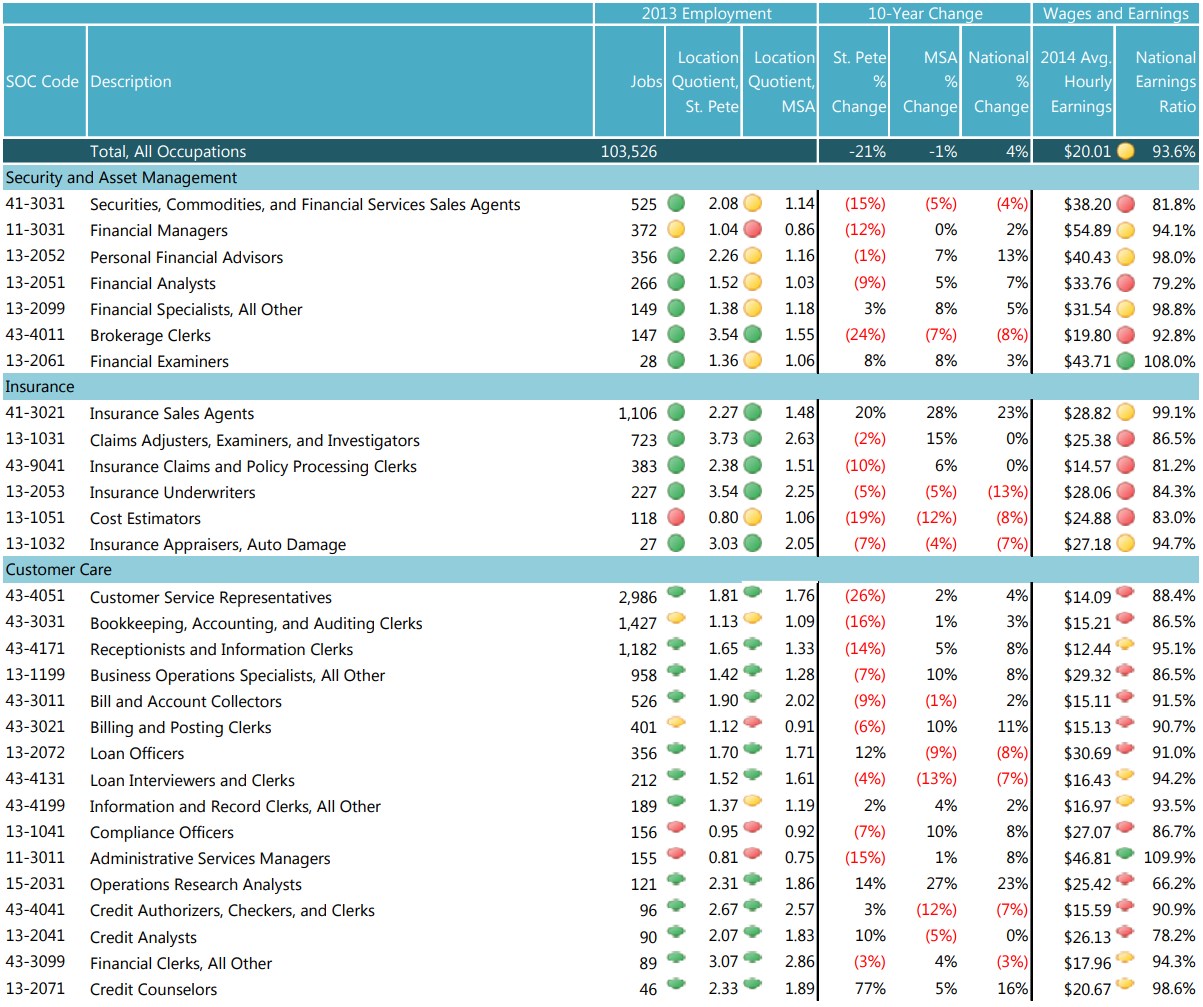

OCCUPATION TRENDS

Across all three Financial Services niches, there is a prevalence of occupations that require at least a four-year degree in business, management, or IT-related majors. The Financial Services target is primarily a knowledge-based economic driver, and firms need talent with a mastery of focused subject matter, communication skills, a penchant to solve problems, the ability to work well with others, attention to detail, and leadership skills. These intangible soft skills make the workforce even more important to the success of Financial Services.

Despite losses over the ten-year period examined, Financial Services skill specializations in the city of St. Petersburg have become increasingly concentrated. For example, in 2003, St. Petersburg’s insurance claims and policy processing clerks had a location quotient of 2.01; by 2013, that number increased to 2.38. These increasing concentrations in occupations are further evidence of the fact that St. Petersburg is home to several large Financial Services headquarters that buttress the city somewhat against large-scale declines in select subsectors

OCCUPATIONAL STATISTICS, FINANCIAL SERVICES TARGET, 2013

Source: EMSI

Note: National Earnings Ratio Color Code based on Tampa MSA Cost of Living Index of 93.2

A phenomenon seen across targets in St. Petersburg, Financial Services workers earn hourly wages much higher than the city average hourly wage of $20.01 but significantly lower than the national wage. There is wage variation among the Financial Services occupational niches, largely because of the difference in degree-attainment necessary for employment. Both the Security and Asset Management and Insurance niches legally require professional certifications for employment, in addition to a college degree. While lower-paying Customer Care positions require less training, they still provide solid opportunities for entry-level employment

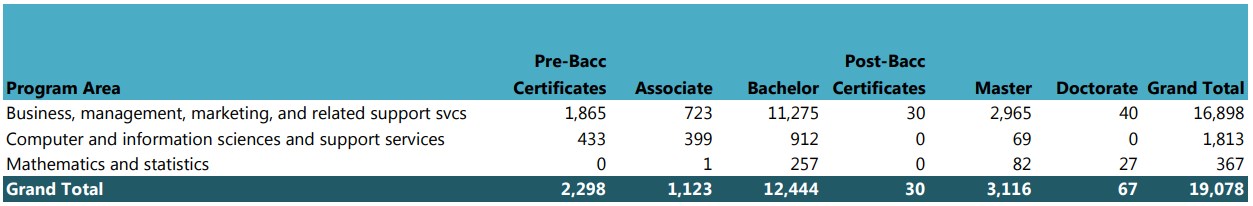

Consistent with employment trends by subsector, Financial Services occupations experienced significant losses during and since the Great Recession. Occupations in all three niches experienced greater losses than the national averages. However, some St. Petersburg occupations that have made rebounds since the end of the recession at a faster pace than the nation. These include: financial examiners, insurance claims and policy processing clerks, insurance underwriters, information and record clerks, and credit counselors.